The content in this guide is currently being revised to align with the new user interface. Some text and images may be outdated.

Accelo Payments streamlines the payment process by automatically charging your clients for your Accelo invoices. Payments offers a wide selection of settings to help you implement your policy for which invoices should be paid, and how the funds should be categorized.

Using this guide, you can

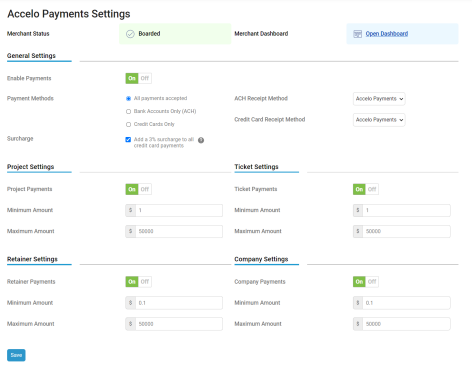

General Settings

The general settings are applied to all payments made by Accelo Payments. They do not affect payments made via other channels, including syncing from an accounting system or recording the payment manually.

|

Setting |

Description |

|

Enable Payments |

Enables automatic payments through Accelo Payments. This is an easy way to instantly disable all automatic payments for any reason. When disabled, you can still record payments manually, and sync them with your integrated accounting system. |

|

Payment Methods |

Determines which forms of payment your clients are allowed to use.

|

|

Surcharge |

When a payment is made using a credit card, a fee is automatically charged to you by the credit card company. That fee can represent a large portion of your profit, even for high-margin businesses. Surcharge allows you to mitigate the hit to your profit by automatically passing the credit card processing fee on to your customers, when they elect to pay using a credit card. The surcharge is added on top of the amount your client is paying, and helps to cancel out the fee that's charged to you by the credit card company. Surcharge is a standard 3% of the amount being paid, and is not applied to ACH payments. |

|

ACH Receipt Method Credit Card Receipt Method |

When Accelo Payments charges your clients, a payment record is automatically created in Accelo. The receipt method determines how that payment is categorized in Accelo, and which ledger the payment should be applied to in your integrated accounting system. You can customize your receipt methods and the account ledger they're associated with by following this guide. Accelo Payments offers separate receipt method settings for credit card payments, and ACH payments. We recommend using a separate ledger for payments received via Accelo Payments, and each of these methods to make them easier to distinguish and reconcile at the end of each month. |

Payment Limits

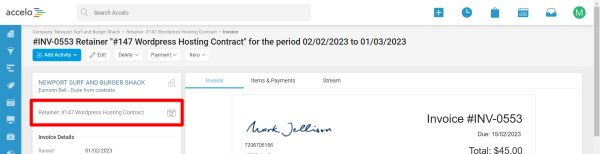

Accelo Payments offers settings to control which invoices are paid automatically. These settings are applied to invoices based on the kind of work which they represent - Project invoices, Ticket invoices, Retainer invoices and general Company invoices. To determine what kind of work an invoice represents, simply open the invoice and check this area:

Payment settings can be used to implement your company policy for credit card payments, setting maximum amounts to prevent unexpected fees, and ensuring that your clients are never surprised by an unexpected charge.

Payment settings can be used to implement your company policy for credit card payments, setting maximum amounts to prevent unexpected fees, and ensuring that your clients are never surprised by an unexpected charge.

|

Setting |

Description |

|

Project/Ticket/Retainer/Company Invoices |

Enables automatic payments for this kind of invoice |

|

Minimum Amount |

The minimum amount which Accelo Payments will attempt to charge automatically. Must be at least $1.00 |

|

Maximum Amount |

The maximum amount which Accelo Payments will attempt to charge automatically. Can not exceed $50,000.00. |